Pomoc Humanitarna i Rozwój w Mali - Porady i Analizy

Interesujesz się pomocą humanitarną? Chcesz wiedzieć więcej o wsparciu dla Mali? Donor-Conference-Mali.eu oferuje praktyczne artykuły i analizy dotyczące pomocy i rozwoju.

Różnorodność wzornictwa roboczych kapot – estetyka i funkcjonalność

Wybór odpowiednich materiałów jest kluczowy dla komfortu i trwałości odzieży roboczej. W produkcji kapot ubraniowych wykorzystuje się różnorodne tkaniny, które różnią się właściwościami oraz zastosowaniem. Profix zwraca uwagę na innowacyjne rozwiązania, takie jak wodoodporność czy oddychalność, co m

Historia i tajemnice zamku Czocha – co warto wiedzieć przed wizytą?

Uszczelki do maskujących listew: znaczenie dla estetyki pojazdów szynowych

Artykuły ostatnio dodane

Elektronika, AGD, narzędzia

Magnetyczny przybornik – jak dbać o jego funkcjonalność i estetykę?

Przybornik magnetyczny to innowacyjne rozwiązanie, które łączy funkcjonalność z estetyką. Umożliwia efektywną organizację przestrzeni biurowej i szkolnej, co przekłada się na lepszą wydajność pracy oraz nauki. Dzięki różnorodności dostępnych modeli oferowanych przez firmę PPHU Max każdy może znaleźć

Produkty i usługi dla każdego

Gryfy proste 30mm w kontekście rehabilitacji – jak mogą wspierać zdrowienie?

Gryfy proste 30 mm odgrywają istotną rolę w procesie rehabilitacji, umożliwiając wykonywanie różnorodnych ćwiczeń angażujących wiele grup mięśniowych. W artykule przyjrzymy się zastosowaniu tych narzędzi w treningu oraz ich wpływowi na siłę, stabilność i ogólną kondycję fizyczną pacjentów. Dowiedz s

Usługi i produkty remontowo-budowlane

Rola jakości materiałów w trwałości bani do kąpieli

Wybór odpowiednich surowców ma kluczowe znaczenie dla długowieczności i funkcjonalności produktów do relaksu w ogrodzie. Różnorodność dostępnych materiałów, takich jak modrzew, stal nierdzewna czy włókno szklane, wpływa na trwałość baniek do kąpieli. Każdy z nich posiada unikalne właściwości, które

Transport, logistyka i pojazdy

Problemy z wtryskiwaczami a zużycie paliwa – co warto wiedzieć?

Problemy z wtryskiwaczami mogą znacząco wpływać na ogólną efektywność jednostki napędowej oraz zużycie paliwa. Objawy usterek obejmują nierówną pracę silnika, spadek mocy czy zwiększone zużycie paliwa. Działanie tych elementów ma kluczowe znaczenie dla prawidłowego funkcjonowania pojazdu. Dlatego wa

Media i badanie rynku

Jak długopisy Parker wspierają rozwój osobisty i zawodowy?

Długopisy Parker to nie tylko narzędzia do pisania, ale także symbol statusu i elegancji. Ich wyjątkowy design oraz jakość wykonania wpływają na postrzeganie użytkownika zarówno w środowisku zawodowym, jak i osobistym. Posiadanie takiego długopisu może znacząco podnieść pewność siebie oraz wrażenie

Gastronomia, artykuły spożywcze

Wyjątkowe prezentowe zestawy z eko sklepiku – co je wyróżnia?

Zestawy prezentowe z Eko-Składzik Anna Ruta wyróżniają się starannie dobranymi produktami, które są zdrowe i ekologiczne. Te propozycje łączą estetykę z jakością, co sprawia, że idealnie nadają się na różne okazje. Unikalność tych zestawów przyciąga osoby ceniące naturę oraz zdrowy styl życia, a tak

Imprezy, śluby, okazje

Promocje dla grup szkolnych na paintball laserowy – co warto wiedzieć?

Laserowy paintball zdobywa rosnącą popularność wśród grup szkolnych, łącząc zabawę z aktywnością fizyczną. To idealne rozwiązanie dla uczniów, oferujące emocjonujące doświadczenia w bezpiecznym środowisku. Korzyści płynące z organizacji takich wydarzeń są liczne, a specjalne promocje dla dużych grup

Ochrona zdrowia i uroda

Jakie są opinie użytkowników na temat skuteczności Stimaral?

Stimaral to suplement diety, który zyskuje na popularności wśród osób poszukujących wsparcia zdrowotnego. Jego skuteczność budzi jednak wiele pytań, dlatego warto przyjrzeć się opiniom użytkowników oraz oczekiwaniom wobec tego produktu. Suplementy diety stają się coraz bardziej istotne w codziennej

Finanse i ubezpieczenia

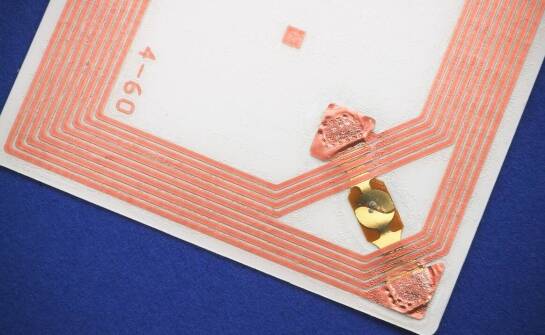

Wybór odpowiednich materiałów do produkcji kart RFID z nadrukiem

Wybór odpowiednich materiałów do produkcji kart RFID z nadrukiem ma ogromne znaczenie dla ich funkcjonalności i trwałości. Właściwe surowce zapewniają nie tylko estetyczny wygląd, ale również odporność na uszkodzenia oraz długotrwałe działanie technologii RFID. W artykule omówimy różne typy materiał

Nauka i szkolnictwo

Kurs języka niemieckiego online jako narzędzie do zwiększenia konkurencyjności firmy

Kurs języka niemieckiego online to konkretne narzędzie, które pomaga firmom szybciej wejść w międzynarodowe projekty i lepiej wykorzystać potencjał zespołu. Decyzja o uruchomieniu programu języka niemieckiego online przekłada się na realną poprawę komunikacji, większe zaangażowanie pracowników i spr

Rolnictwo, zwierzęta i rośliny

Mech chrobotek w dekoracjach ślubnych – jak stworzyć niezapomnianą aranżację?

Mech chrobotek reniferowy zyskuje popularność w dekoracjach ślubnych dzięki swoim unikalnym właściwościom. Brak potrzeby podlewania oraz antystatyczność sprawiają, że idealnie komponuje się w różnych stylach weselnych. Jego zastosowanie przynosi wiele korzyści, takich jak trwałość oraz oszczędność c